If this makes you sweat, keep reading …

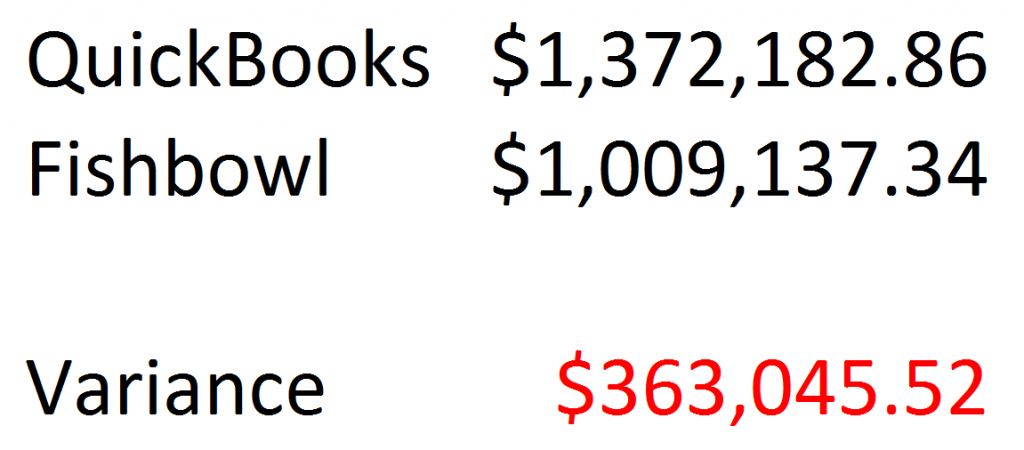

If you integrate with Fishbowl and QuickBooks (any accounting system) you should read this blog post, and at most give us a call. I’m talking about Inventory Valuation Variance, and it is the basic idea that the QuickBooks Inventory Valuation does not match Fishbowl Inventory Valuation.

There are a lot of reasons why, and various ways to fix it. However, I will say I’m not a CPA, or anyone authorized to speak with authority on accounting. At the same time, I’m one of the only ones in the Fishbowl Community who is comfortable with both systems.

What is Inventory Valuation Variance?

Inventory Valuation Variance (IVV) is a simple idea, and one most Adults will understand. Remember balancing a Checkbook? It is the same thing. Previously before the internet (and I still remember being taught this) how much money you had in the bank was purely up to you to capture and detail deposits, and payments. Get it wrong, most of the time is not crippling; but over time if you start bouncing checks you are immediately aware that your own personal records do not match the bank.

So you have to investigate why there is a variance.

Fishbowl and QuickBooks work together to provide features not available in both systems, but its very easy to cause problems in both. The only way you know if the two systems are working well together is if the Inventory Valuation match.

Why is this a problem?

A lot of things can go wrong if QuickBooks and Fishbowl’s Inventory Valuation do not tie. Here are a few.

- Insurance – Who has the right Inventory Valuation?

- Property Tax – Most States have a Commercial Property Tax, again which one is the right number?

- Audits – Do you comply with Audits? They will catch this, and will raise red flags.

- Margins – If you have systematic Inventory Valuation variances, then you cannot trust Order Level Margins; they are most likely incorrect.

- Fraud – With a higher level of variance, there is a lot of “slop” that problems with fraud could explain away.

Personally, I’m most uncomfortable with Tax and Fraud concerns. Most of the time a company can fix their own Bookkeeping issues, and no one else needs to know.

Its the instances where we have to explain to outside entities that the books are not accurate. Awful.

What causes it?

Most of the issues we’ve seen has been through improper training. Fishbowl updating QuickBooks by default is fine; but using both programs improperly will cause all sorts of problems.

The largest driver of process problems is cash. Cash in (deposits), and Cash out (payments). No vendor or accountant will accept an improperly written check for the wrong amount; so the drive to “fix” the amount is huge, and it happens naturally.

The Generated Fishbowl Receipt as QuickBooks Bill says $1000, but the Invoice from the vendor says to pay $1200. The document in QuickBooks is updated to $1200 and a check is cut.

The biggest problem with this is that depending on how one updates the Bill to $1200 is how it effects Inventory Asset on your Balance Sheet, most likely it already has.

Other causes:

- Bill updated to match vendor Invoice

- Bill deleted

- QuickBooks Inventory Items

- Mismapped Accounts

- Credit Card Reconciliation

How can I fix it?

Training

Develop and improve internal training. The more education the Accounting team has on how best to treat QuickBooks and Fishbowl transactions will go a long way in preventing and catching these issues.

Simplify

I have seen some really complex books. My personal belief, is that most businesses need about 10 or so Inventory Asset/Cost of Goods Sold/Income accounts at the most.

If you have 500 products, you do not need to have 500 Sales Income Accounts, 500 COGS accounts. This has happened before. Is not smart, and it is difficult to track down problems.

Close your books

QuickBooks has a feature to close your books by date. Use it.

There have been many situations where the QuickBooks Closing Date feature would have exposed procedural problems sooner, before it all adds up.

How can ILC help?

It depends, in the most simplest case just having an honest discussion about Fishbowl and QuickBooks we can resolve problems together.

In more complex situations we closely monitor QuickBooks Inventory Asset and Fishbowl to find problems. Rarely if ever do we find issues in Fishbowl; its mostly in QuickBooks due to transactions changing.

We will use a mix of Custom Reporting, Monitoring Applications, and Advanced Analysis with Tableau to find the variance.

Then once we find the cause the Variance, we work with the Accounting Team to adjust the books correctly. However, this is where the help from the customer’s CPA is requested. Its a mix of judgement and estimation to re-book the variance to the correct accounts.

Then after this is done, we move on with a better understanding of Fishbowl and QuickBooks and improved confidence in the system.

If you have any questions give us a shout, tell us about your Adventure in Accounting and maybe we can help.

-Israel